Financial literacy is one of the most important aspects of being a professional creator. But, unfortunately, there isn't a whole lot of information out there helping creators make, manage, and invest their money.

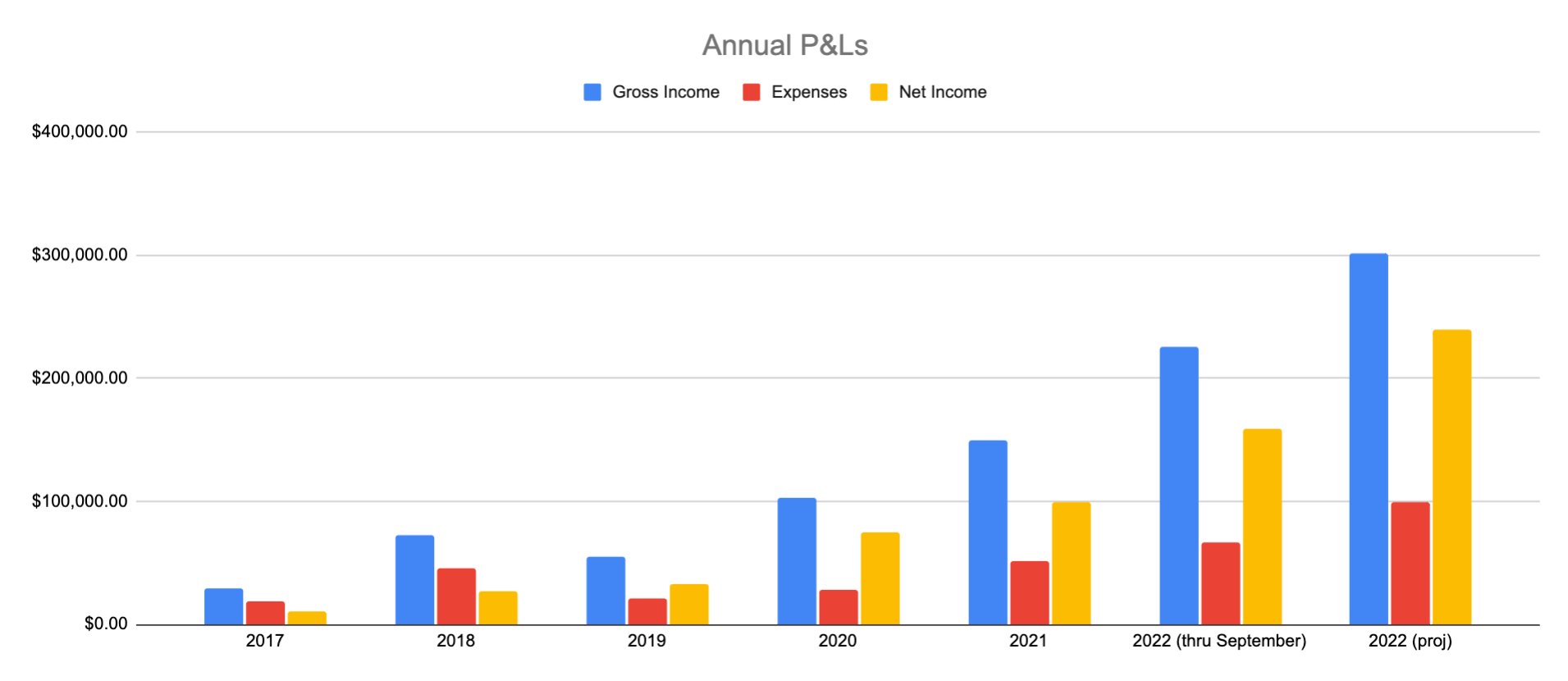

I've never felt more comfortable and confident in my finances. This year, I'm on track to generate ~$300,000 in top-line revenue. That's about double last year's revenue and more than double the Net Income total:

I'm grateful that I can easily access historical data like this – luckily, I've always kept good records. Not only that, but I've gradually improved my record-keeping system over time.

Today, I have a monthly bookkeeping process and also pay myself bi-weekly through Matt Giovanisci's slightly modified Profit First system:

Having a good handle on my own finances has been super empowering as a creator and allowed me to make really savvy decisions about where, when, and how I spend my money. And I want to help other creators build a similar system – at least inspire you to prioritize this.

In 2008, Pat Flynn pioneered the public Income Report for creators. He decided to openly share how much he was earning, how he was doing it, and what he was learning from the process.

Pat is a major inspiration for many creators today (myself included) and I feel lucky to call him a friend and mentor.

It's pretty incredible to dig into Pat's archive here. But those income reports stopped in 2019, and the game has changed a lot since then. In fact, the game is always changing – and I don't see many creators today sharing their income reports in a very open, instructive way.

So I wanted to share my own income report from last month (September 2022) and some takeaways.

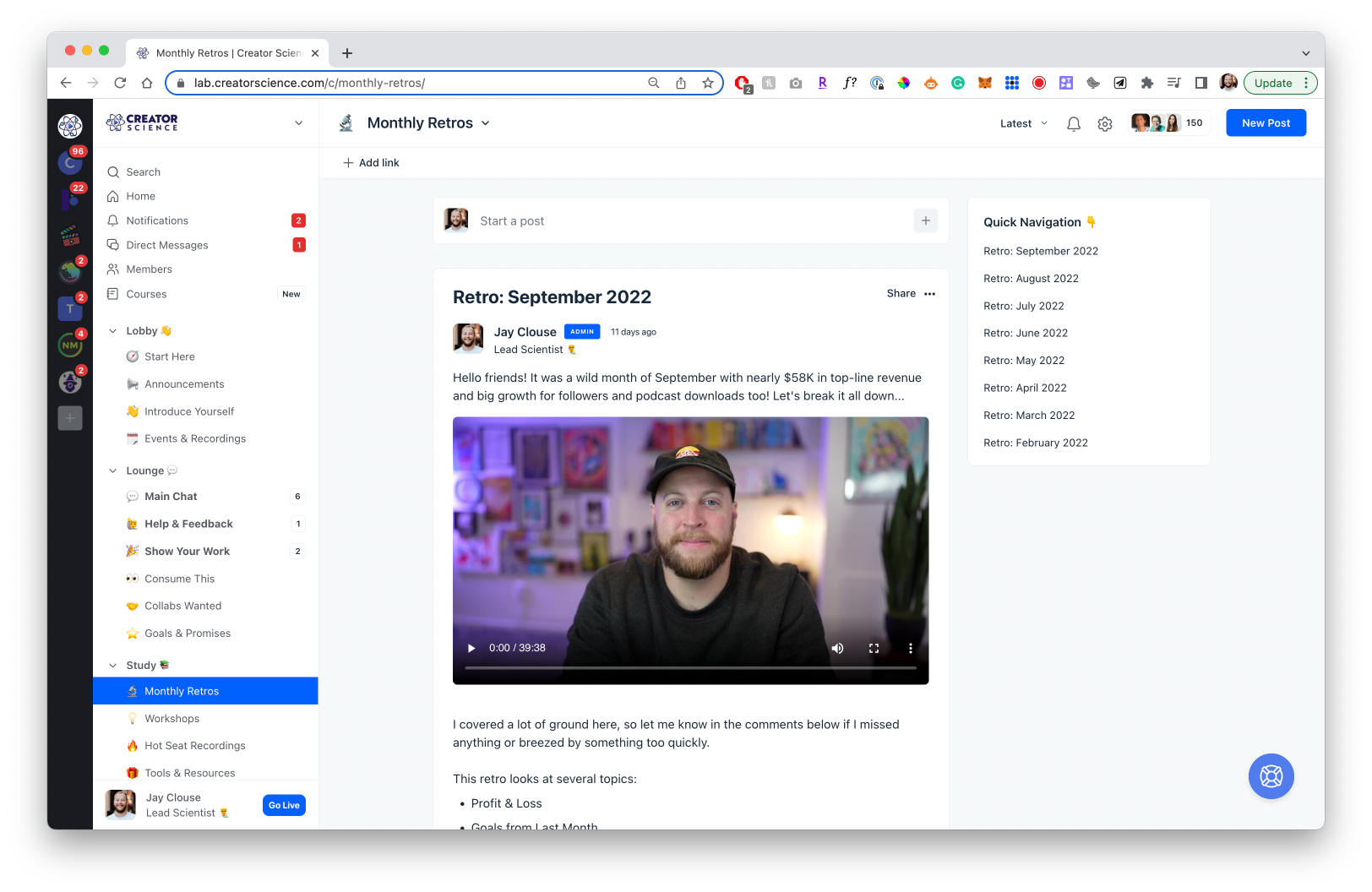

I likely won't share this on the blog every month – but I do share it every month inside The Lab. I record a 30-40 minute deep-dive into my full Profit & Loss (P&L) statement, my wins, lessons learned, and the changes I'm making. Members tell me it's one of their favorite aspects.

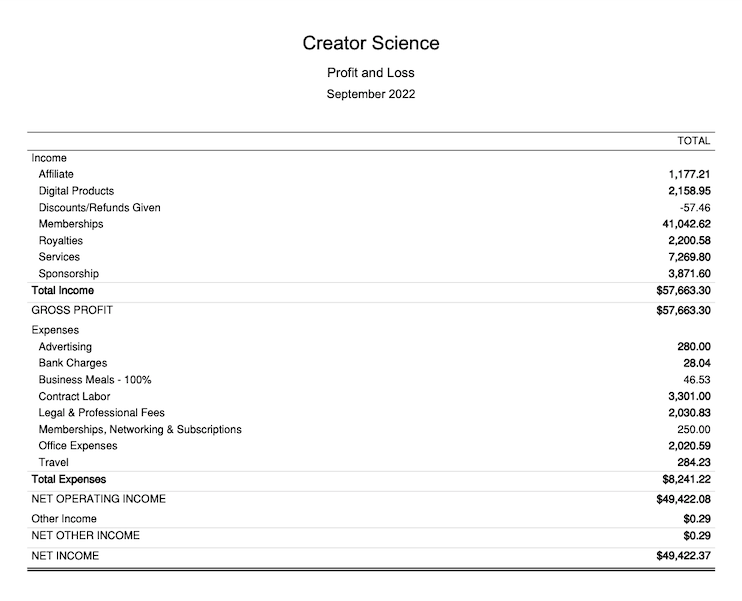

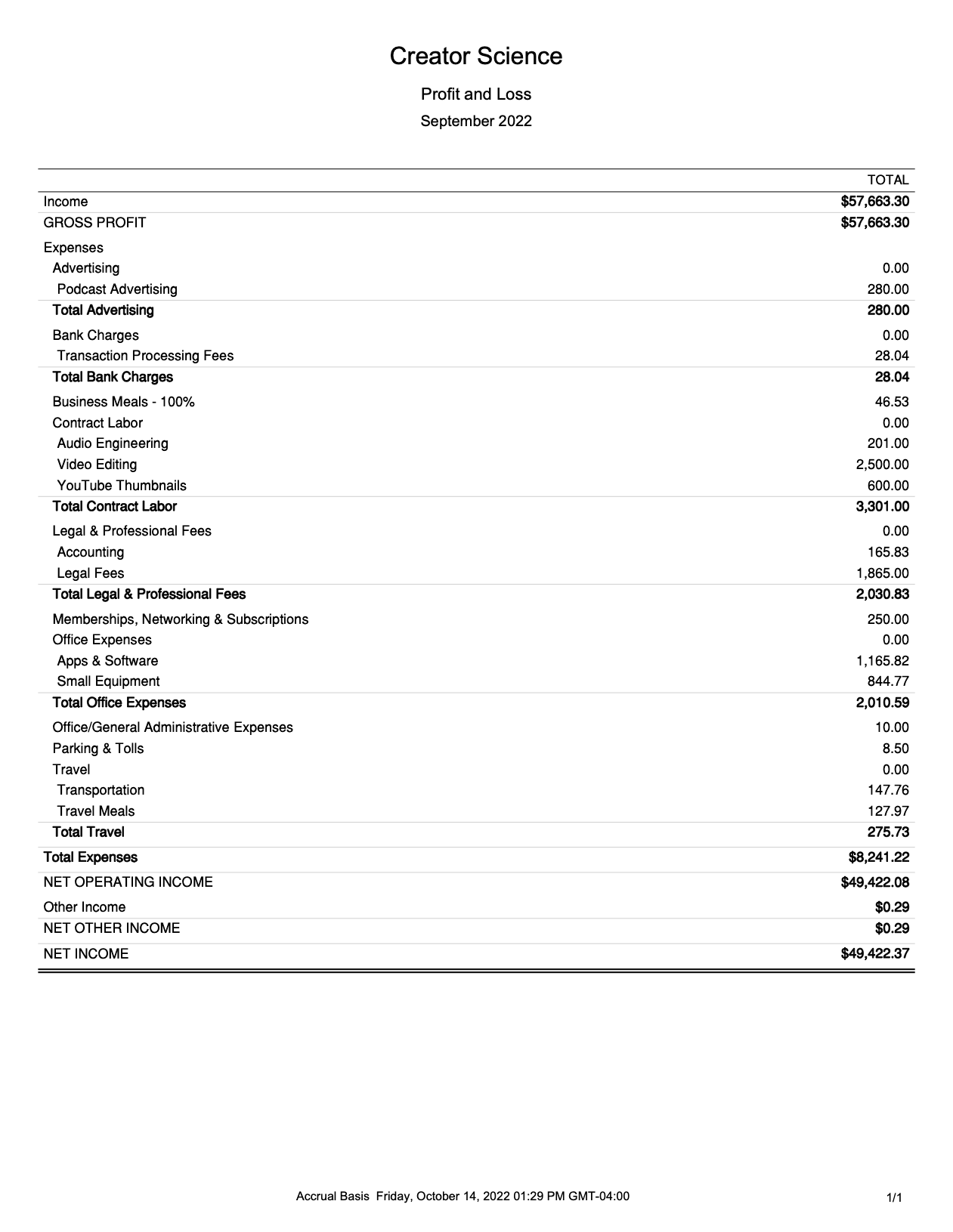

So let's start with my P&L. This shows my gross income, expenses, and net income. And worth noting – these numbers are recognized revenue (i.e. the money entered my bank account). It does not take into account receivables (sales of products that haven't actually hit my bank account yet).

Here's what the consolidated version of my P&L looked like for September:

This data is pulled directly from QuickBooks (affiliate) and actually breaks down much further than this. On a monthly basis, not only do I see a detailed breakdown of my 7 major revenue streams, but also my expenses.

For September:

Income: $57,663.30

- Expenses: $8,241.22 _

Net Income: $49,422.47

Note: expenses don't capture tax withholdings or my compensation. As Matt outlined in the Profit First video above, every dollar that enters my business is split into:

- Tax withholdings (25%)

- Owner's Compensation (30-40%)

- Operating Expenses (30-40%)

- Profit (5%)

Depending on cash flow and current projects, sometimes I will choose to retain more money in Operating Expenses vs. Owner's Compensation.

Assuming an even 35% split for Owner's Comp and OpEx, September's allocations looked about like this:

Total Income: $57,663.30

Taxes: $14,415.83

Owner's Comp: $20,182.15

Operating Expenses: $20,182.15

Profit: $2,883.17

So the $8,241.22 in Expenses shown on my P&L is all paid for via the Operating Expenses bucket.

I should also say that September was my best month ever. For most months this year, I've been around $22-25K in top-line revenue (Total Income).

Let's get into more detail by diving into one side of the P&L at a time.

Income

Every month, my income is categorized into seven major categories:

- Affiliate Income

- Digital Products

- Memberships

- Royalties

- Services

- Sponsorship

- Patronage

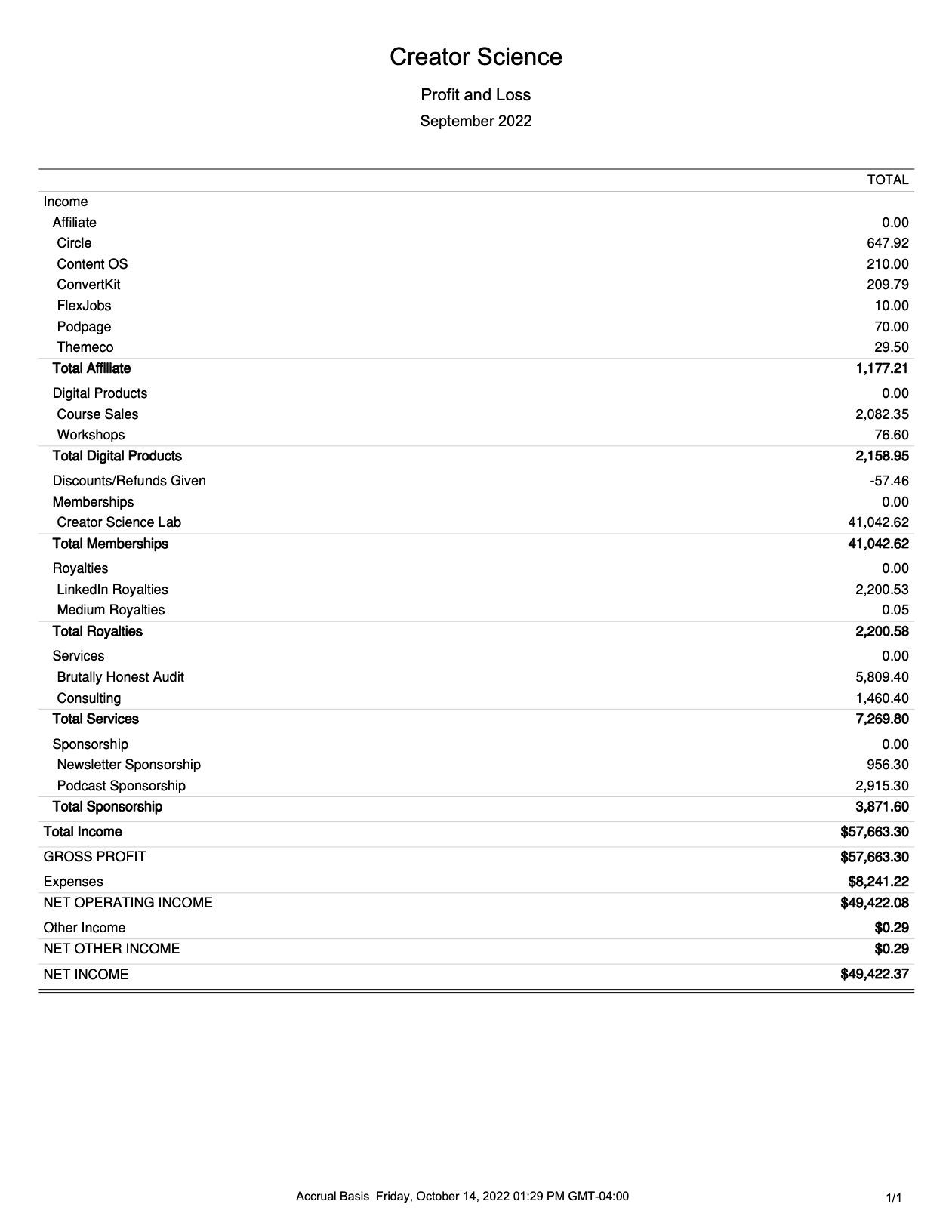

Seven categories, but each category has several sub-categories below it. Here's what the expanded view of September's income looked like:

These categories and subcategories oscillate month-to-month. Sometimes I have an incredible month of sponsorship, and other months I don't recognize any sponsorship revenue at all. The same is true of certain affiliates, services, and even memberships.

But by having so many active revenue streams, the business is super resilient and remarkably consistent. There are a lot of months where I may have had a great month of sales (sponsorship revenue, for example) but none of that revenue actually hit my bank yet – typically due to net-30 or net-60 payment terms.

It can be really challenging to manage your business if your cash flow is swinging wildly from month to month. So having years of data is super helpful to understand, regardless of swings, the average revenue you can expect on a monthly basis.

Let's break down these income buckets further so you can consider adding them to your own business...

Affiliate

Affiliate revenue is the commission you earn by selling someone else's products or services to your audience. I'm an affiliate for dozens of different products or services (if not 100+) that I've used and admired.

By becoming an affiliate of those products, I can recommend them and be compensated for the sale of those products – typically a percentage of the sale.

I'm a HUGE proponent of Circle and ConvertKit. I recommend them often to other creators, and if those creators signup via my link, I'm rewarded with a small commission. I'm very upfront about affiliate links (like those two above) and I only recommend products that I genuinely would support – even if I wasn't an affiliate.

As an affiliate, my favorite programs are software. A lot of software companies will pay a recurring commission as long as the customer remains in good standing. So as you promote a product over time, you can actually build a predictable (and growing!) stream of income from those products.

Since I use Circle for The Lab and have so many readers who also build membership communities, I've been able to build that into a nice monthly payment.

Candidly, I think I'm way underperforming here. A lot of creators who take affiliate revenue seriously can build MASSIVE revenue streams from affiliates alone – Ryan Robinson earns $30-50K/mo in affiliate revenue alone.

Over the coming months, I may put together some intentional campaigns for some of my bigger affiliate partners. Not just software, but some other creators I admire.

Digital Products

Digital products are digital assets you build once and can sell over and over again.

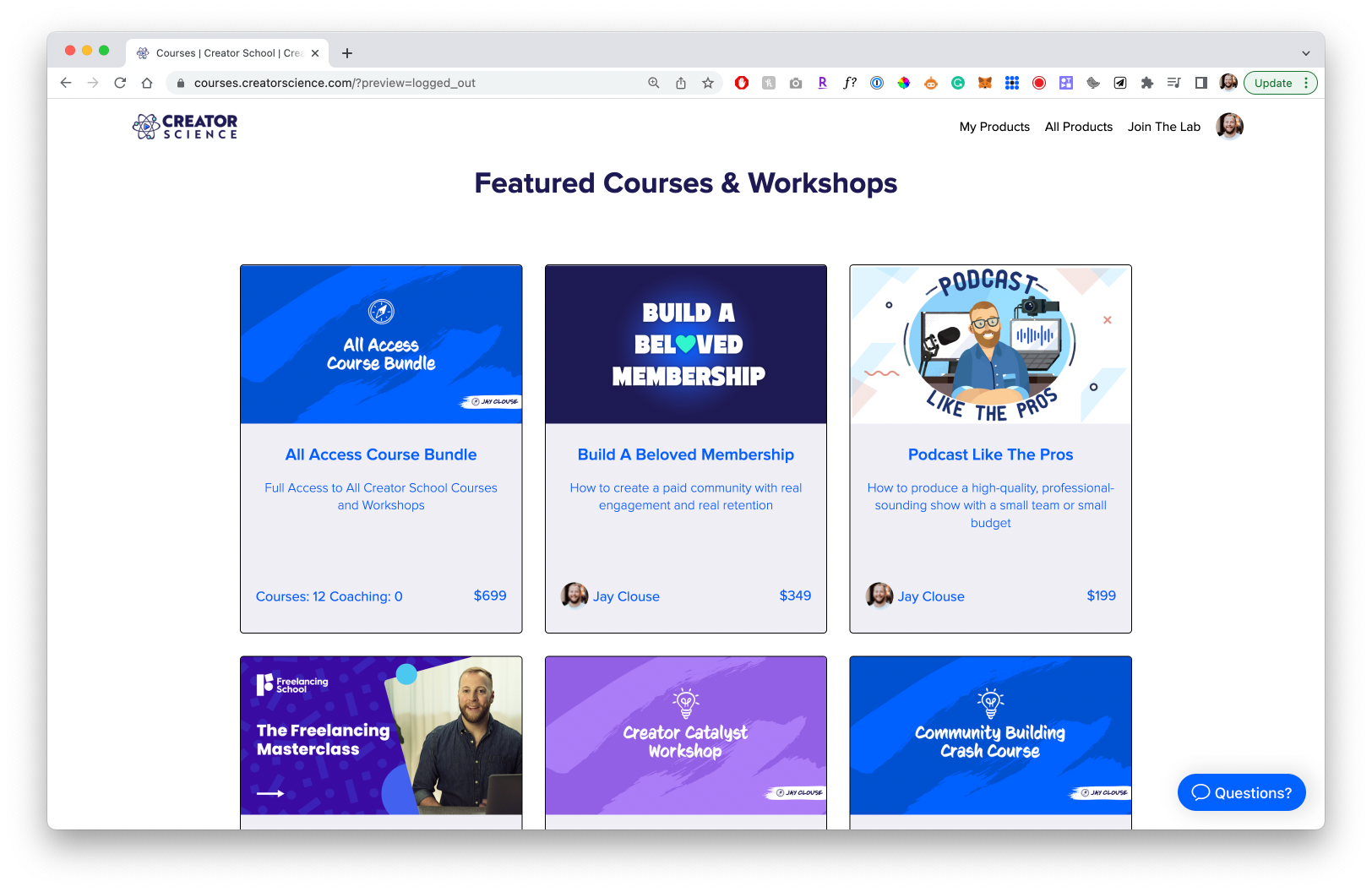

For me, these are my courses and workshops:

Digital products could also include Templates, Downloadables, and more.

Digital products seem to have gotten a little less popular over the last year with the rise of community-based experiences (Memberships, Cohort-Based Courses) but I'm still bullish on them as one of the most major aspects of my business in 2023.

Right now, I'm in the middle of building my newest course, Build A Beloved Membership. It's already generated thousands in revenue and it's still in presale.

Right now, though, digital products are still underperforming as an overall part of my business.

Memberships

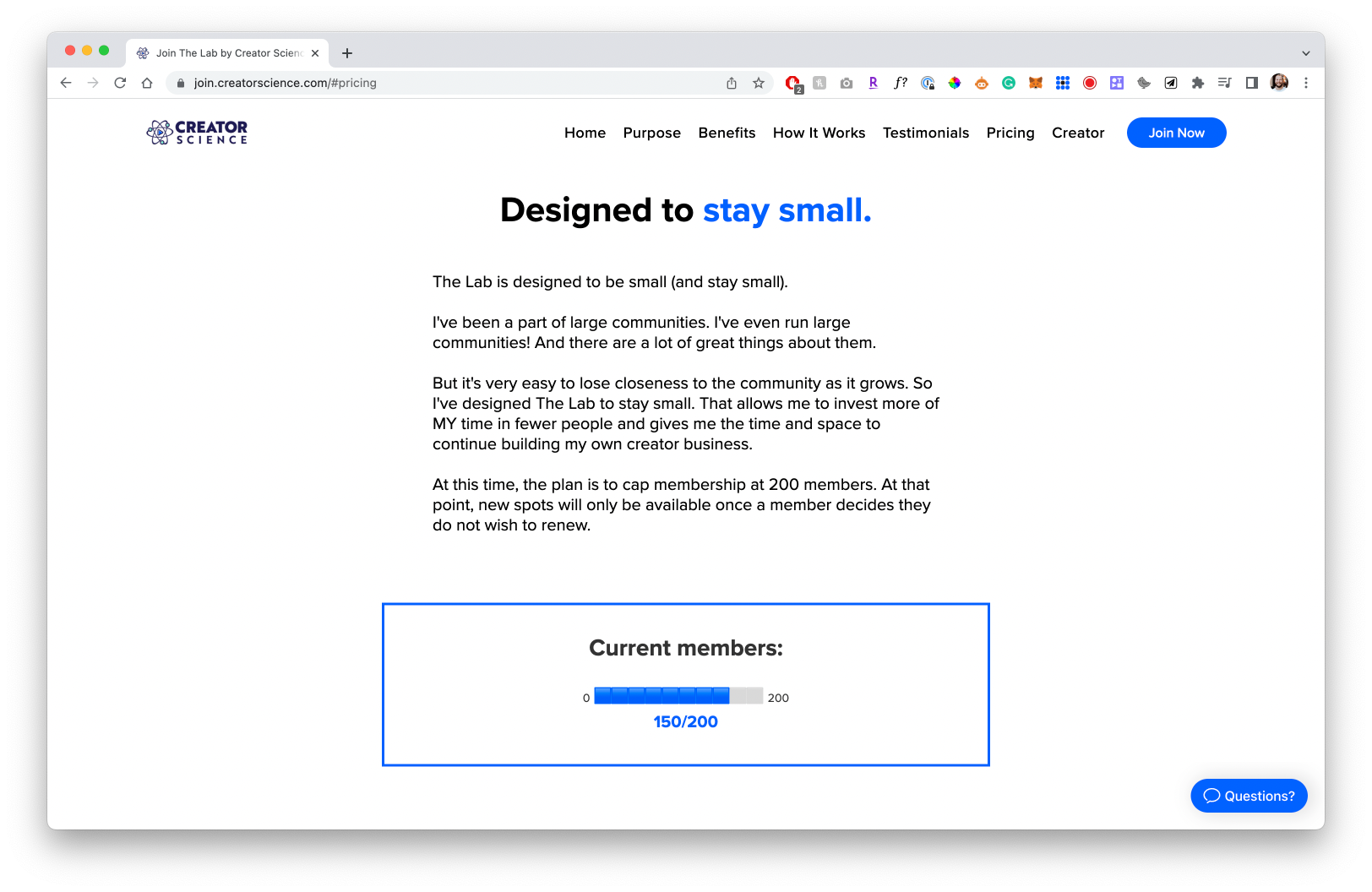

Memberships are recurring subscription products. For me, it's my membership community, The Lab. But this could also refer to a content membership (e.g. every month I provide you something) or things like Patreon.

Building The Lab is probably my most impactful decision of the year.

Not only did it bring in more than $41K in September alone, but it's also generated nearly $120K since March – that accounts for 50% of my total revenue this year.

September was a high month for memberships because of two big decisions:

- I raised the price of membership

- I decided to cap membership at 200 members

As a result, a lot of people chose to join The Lab before the price change. And now that we are 75% full, other people are choosing to join rather than risk losing their opportunity.

The Lab is an annual subscription, so every month right now Membership revenue starts back at $0. To maintain a similar overall revenue total month-to-month, I need new members to join The Lab.

However, by offering an annual membership that is open to join at any time during the year, it will have a really interesting effect in year two – I will experience Annual Recurring Revenue on a monthly basis, effectively mimicking Monthly Recurring Revenue (MRR) as long as members choose to renew.

Of course, some members will choose NOT to renew, but by generating $120K in ARR this year, I'm setting myself up to have similar (or greater) success NEXT year as well. And I won't need to constantly create new customers, I just need to keep serving my existing members well.

Royalties

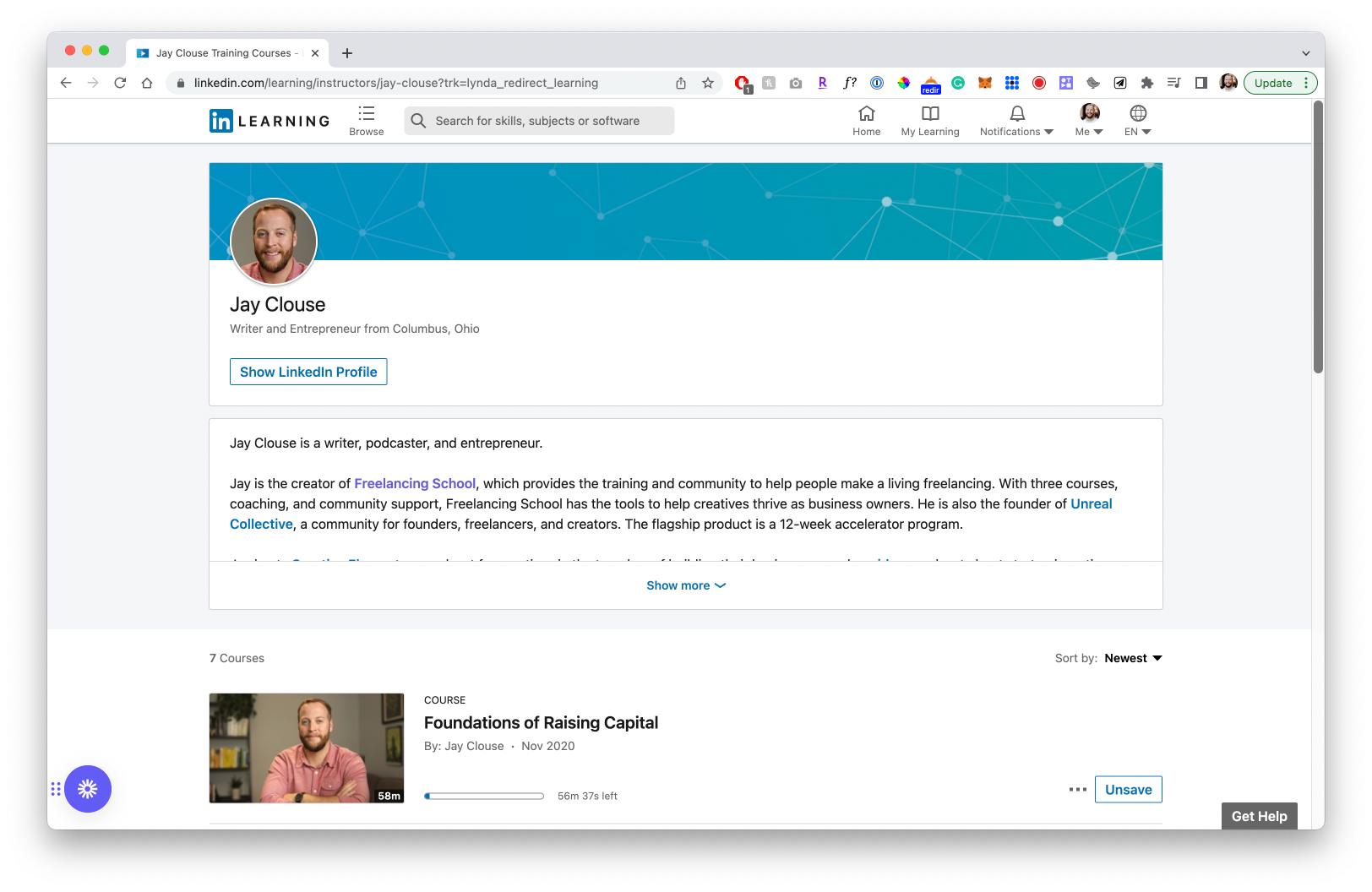

Royalties are payments based on publishing agreements. Typically, publishers license your IP (intellectual property) and then pay you a fee based on their own ability to monetize that IP.

My main source of royalties comes from LinkedIn Learning – LinkedIn's courses platform. Together, we produced 7 courses that they sell on their own platform, and I'm paid a certain monthly commission based on the popularity of those courses.

I've also received small amounts of royalties from a service that translated my course into Chinese (that was a fun, weird experiment), being featured in Arlan's Academy, and I get like five cents from Medium every month.

You also see royalties in book sales – authors are paid an Advance (short for "Advance on Royalties") and then sent Royalties once that Advance has been earned by the book.

Royalties are also seen in the music industry – artists are paid royalties by their label based on how well a song performs.

Also within this world is Licensing – a fee paid for the exclusive or non-exclusive use of your work. Commercials will pay a set licensing fee to utilize music, for example.

Services

Services are agreements that trade your time for money. That may be hourly, monthly, or project-based. I even put "productized" services in this bucket – services that are packaged like products, but still require an effort of fulfillment once they are sold.

In September, I created a new productized service called Brutally Honest Audits based on a positive reaction to this Tweet:

Thinking about offering a service called something like "Brutally Honest Audit."

— Jay Clouse (@jayclouse) August 30, 2022

I spend 40 minutes looking over your online presence & recent work, and then I deliver a Loom with the feedback people are (probably) afraid to tell you but is likely holding you back.

Thoughts?

That service sold really well – but I ended up needing to fulfill more than a dozen of these audits within a seven-day period.

It was rough.

I still offer this service, but I don't market it very widely.

Typically, my services break into two buckets:

- Coaching – an ongoing relationship with one individual helping them achieve some goal or reach some outcome.

- Consulting – typically a one-off relationship with a person or organization who wants to quickly access my knowledge and experience to give them a shortcut to their desired outcome.

Most of my consulting relates to helping people start and improve their membership communities – but I'm generally open to other requests. In either case, I no longer offer any type of implementation work – advisory only.

Want to work together? Hire me here

Sponsorship

Sponsorship revenue is generated by promoting another brand, product, or service. It's actually pretty similar to Affiliate revenue, but the revenue is agreed upon upfront and not based strictly on performance.

I currently offer sponsorship on three of my digital properties:

- Creator Science Newsletter

- Creative Elements Podcast

- Creative Elements YouTube

Managing sponsor relationships can actually be pretty time intensive, so I've formed relationships with the ConvertKit Sponsor Network to sell my newsletter sponsorship and the Podglomerate to sell my podcast sponsorship.

These are revenue-share agreements, which I love. The more these partners sell, the more revenue they earn themselves. By aligning incentives, everyone wins.

My sponsorship is sold on a CPM basis ("cost per mille" which means per 1,000 impressions). For example, my podcast ads sell for about $40 per CPM. At about 50,000 downloads/month, that means one ad unit deployed in each download would be about $2,000 net (50,000/1,000 * $40).

That model is only really useful for digital properties with a larger audience. If you have 1,000 downloads/month, a $40 CPM would only net you $40.

You can always sell your OWN sponsorships to brands and pitch your own payment terms (e.g. $200 per episode). I've done this in the past and it really works – you just want to select sponsors who don't need a ton of conversions to see a financial Return On Investment. That will help you find partners that also want to renew.

In general, I'm happy with how sponsorship is going for my business, and there's so much room to grow here. But as far as September goes, it wasn't a big month for recognized income.

Patronage

Patronage is money donated by your fans for no other reason than to support you. It's not about a transaction – they are just expressing appreciation for your work.

Patreon could be seen as Patronage, but if you're promising ANYTHING as part of that transaction, I'd classify that as Membership revenue.

My Patronage comes in the form of BuyMeACoffee donations. But, truth be told, this has only amounted to $210 this year and I don't need that revenue. So I'll actually be removing this from my digital properties in the near future.

Expenses

Onto the second half of the P&L: Expenses.

Expenses aren't discussed nearly enough. It's very common to see a creator brag about their revenue numbers ("I had a seven-figure launch!") but never disclose their expenses. Some of those creators bragging about a 7-figure launch also spent in the high 6-figures through advertising!

A healthy business is one that doesn't focus on top-line revenue but on profitability.

Now, there is a very sound argument to be made related to tax strategy – Amazon focused on being at breakeven for a long time, investing all of their profits back into the business.

I don't disagree with that at all – I'm working through my own tax strategy right now and thinking about where I can strategically invest some of my profits.

But until you're pretty financially savvy, you probably want to focus on profitability.

That means being smart with your spending – it should be aligned with your goals. If you want to take home more of the cash you earn, you need to make sure your spending habits are helping you achieve that goal.

Here's where I've been spending:

Let's break that down further...

Advertising

A lot of creators will beat their chest and shout, "I've never paid a dollar for marketing or advertising!"

That's an amazing spot to be.

But advertising is an incredible, strategic choice that you can make. If you have something that is already growing organically...why not invest in spreading that thing faster? After all, if you think of your business as a machine, advertising can be a terrific part of increasing your output.

This year, I've played around with a lot of experiments in paid acquisition.

I want high-quality podcast listeners, YouTube viewers, and email subscribers. And I've found that if I convert someone into an email subscriber, that gives me weeks, months, or even years to convince them to try the podcast at some point. I also find that email subscribers are easier (cheaper) to acquire than podcast listeners.

So my strategy is predominantly on email. Namely, I mostly sponsor other newsletters in an effort to grow my newsletter more quickly.

These campaigns have had SUPER mixed results, but I think the strategy is sound.

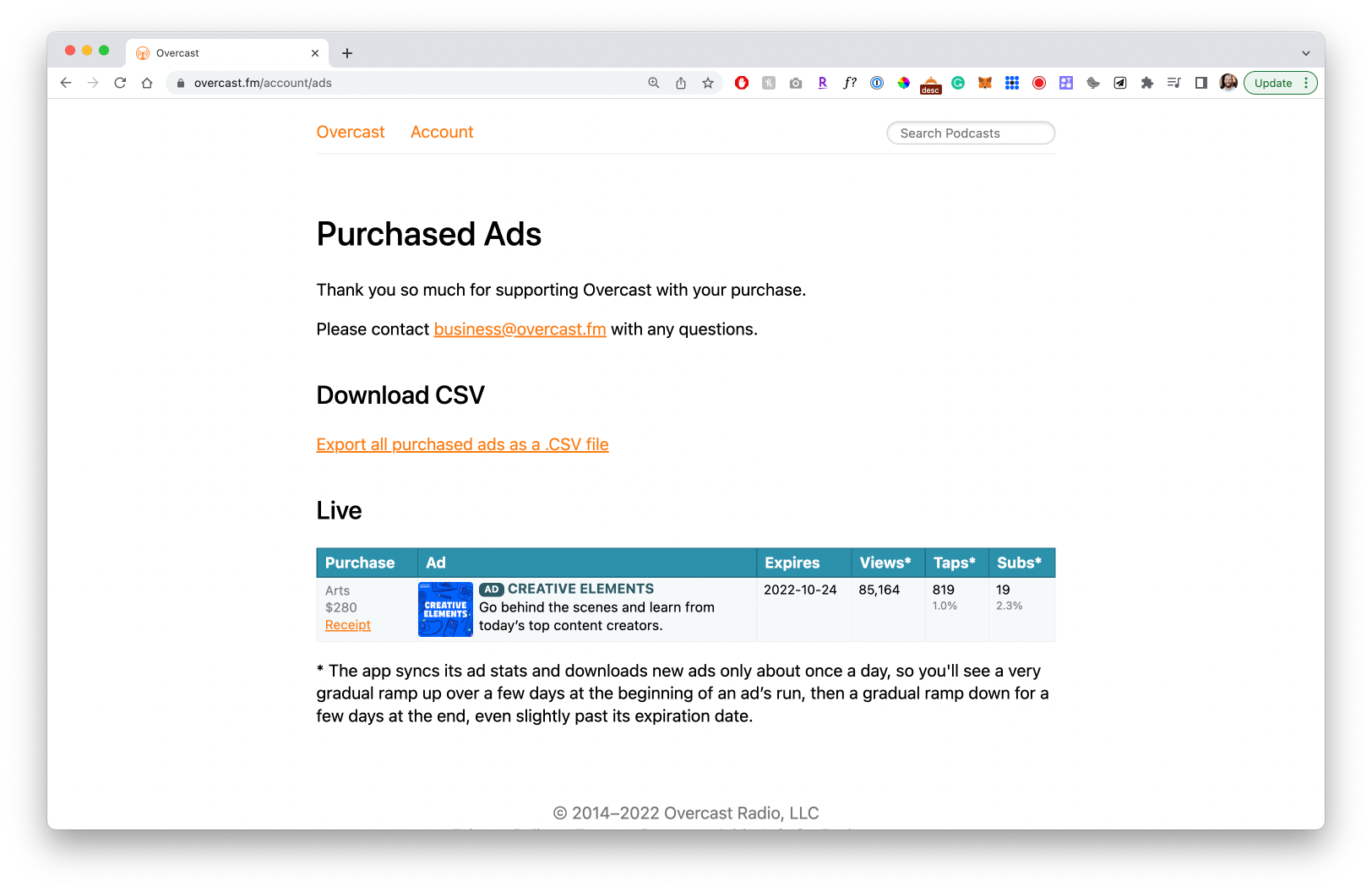

It's worth noting, I have tried paid acquisition for audio and video too. The $280 spent this month is on an ad in Overcast.

Contract Labor

Contract labor includes the people or companies you hire on a contract basis. This is both my highest area of monthly spending and the fastest-growing.

Right now, my biggest investment is going into the YouTube channel. I've hired help with audio engineering, video editing, and thumbnail production.

We want to increase our video output, which means this area will likely increase for me in the near future – not to mention potentially hiring a personal assistant.

As the business grows, I'm pushing myself to invest here more. The more I invest here, the more I can take off my plate (I've identified 37 recurring tasks I'm still personally doing) and the more I can focus on the creative work.

Legal & Professional Fees

To be honest, I don't know why this is a separate line item from Contract Labor – it's probably related to how this is reported on my annual return.

But, each month, I pay for bookkeeping and sometimes legal support as well.

Recently, I hired a lawyer to help me think through how my tax strategy maps to my legal entity and another lawyer to help me file for some Trademarks.

Office Expenses

Office expenses typically break into two major subcategories – software and small equipment. I typically spend $1,000-1,500/mo on software (which is a lot). I think I could cut back here a bit, but this total is mostly spread between a couple of BIG expenses (like my email service provider and learning management systems) and not so much a ton of little ones.

I rarely purchase actual equipment, but this year I've invested in a new laptop, the gear for my home studio, and a new iPhone.

Travel

I don't do a lot of traveling, but when I do, it's almost always for work. Typically I put my airfare and lodging costs on the company card, as well as qualified meals.

In September, I traveled with Mallory to Huntington Beach, which included a speaking gig. Business trip!

Conclusion

As the business grows, matures, and continues to perform at a higher and higher level, I feel a push to double down and invest more. More help, better equipment, etc.

But it's a scary thing! No matter how consistent my spreadsheet tells me my monthly revenue is, it still doesn't feel real. These numbers are insane to me.

So lately I've been trying to talk about these numbers a little bit more openly so I can normalize them in my own mind. If I think of these numbers as an anomaly or aspiration (vs. predictable) then that's what they'll become.

So, to reiterate, there are a few things I'm grateful for implementing:

- Keeping good records in QuickBooks

- Hiring accounting & bookkeeping help

- Implementing Profit First accounting

- Continuously adding new revenue streams

- Tracking my KPIs each month in a spreadsheet

If you're able to do that, you'll feel so much more comfortable and confident with your finances. And once you begin looking at money as an abundant TOOL that you can leverage vs. a scarce, mythical thing you just can't seem to get enough of...good things happen.

If you enjoyed this Income Report, here's a full Retro from May 2022:

This is what you can expect to see from me every month inside The Lab – and we'd love for you to join us!

Questions? Drop a comment below 👇

Join 54,000+ creators learning from firsthand experiments, expert interviews, and actionable advice every week.